By Guy Matthews, Editor of NetReporter

SD-WAN has unquestionably been one of the most important developments in enterprise connectivity in the past several years. But given the impact of the COVID-19 pandemic what lies ahead for this market?

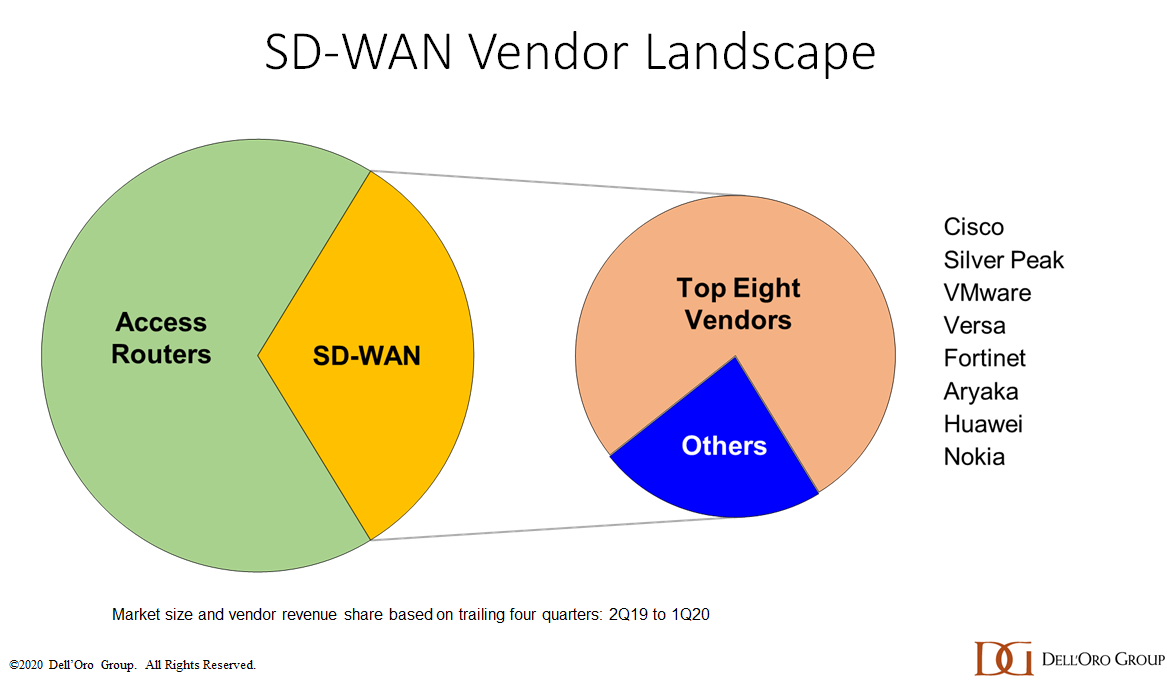

The last few years have seen increased demand for the kind of flexibility, scalability, efficiency and security that SD-WAN can enable. It has been a dynamic market for start-ups and veteran networking vendors alike. We’ve seen the acquisition of hot new players by established names, with CloudGenix, VeloCloud, Viptela and Nuage Networks acquired by Palo Alto Networks, VMware, Cisco and Nokia respectively. Key players such as Versa Networks, SilverPeak, Fortinet, Aryaka are also currently thriving. So what’s next?

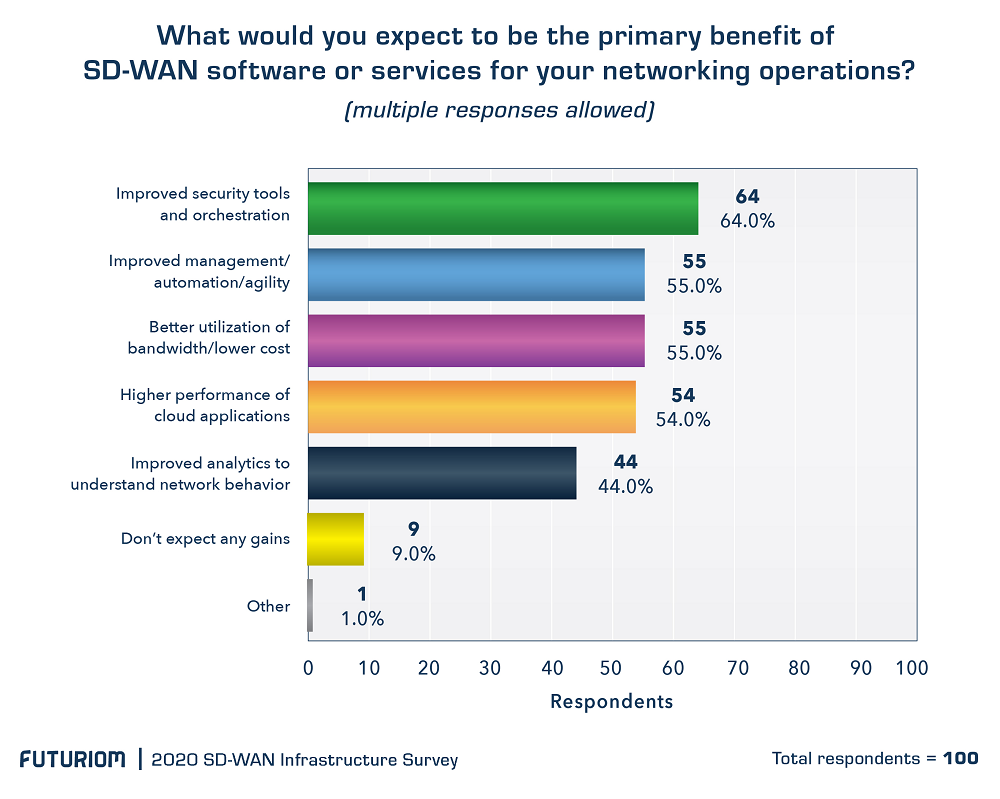

Scott Raynovich, Chief Technology Analyst with analyst firm Futuriom believes the future looks good: “There are so many different applications and use cases for SD-WAN,” he points out. “At Futuriom we try to nail down why people are buying SD-WAN and what they see as the benefits. This year people see SD-WAN increasingly as a security tool.”

Scott Raynovich, Chief Technology Analyst with analyst firm Futuriom believes the future looks good: “There are so many different applications and use cases for SD-WAN,” he points out. “At Futuriom we try to nail down why people are buying SD-WAN and what they see as the benefits. This year people see SD-WAN increasingly as a security tool.”

“We found that 64% of people we asked said the main benefit was to improve security tools and orchestration of security,” adds Raynovich. “SD-WAN is also often seen as a way to compliment MPLS circuits or other private circuits and give you a cheaper way to leverage broadband or internet in a secure fashion and lower the cost of your bandwidth.”

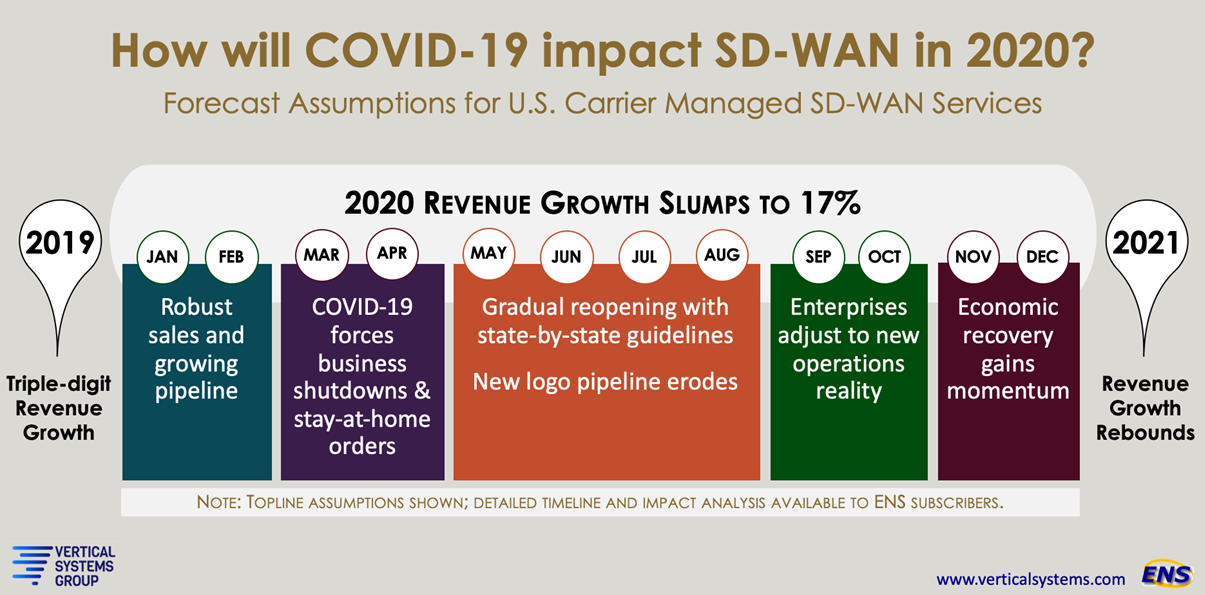

Erin Dunne, Director of Research Services with analyst firm Vertical Systems Group, views the market through a slightly different lens: “We are focused on carrier-managed SD-WAN services,” she explains. “We define that as a carrier-grade offering for business customers that’s managed by a network operator, meaning you are paying a bill to a network services operator on a monthly basis.”

Erin Dunne, Director of Research Services with analyst firm Vertical Systems Group, views the market through a slightly different lens: “We are focused on carrier-managed SD-WAN services,” she explains. “We define that as a carrier-grade offering for business customers that’s managed by a network operator, meaning you are paying a bill to a network services operator on a monthly basis.”

“If you look at a timeline of what’s happening in the SD-WAN carrier managed services market, we saw triple digit growth in 2019 – a very healthy and robust market,” she adds. “We saw that continue into January and February of this year. In March, we start to see the demand side stifle due to the pandemic. Installations couldn’t get into the building, enterprise customers all went home, implementations are starting to either be deferred or cancelled. The hope that later in the year we’ll start to see revenue kick back up and pipelines start to recover.”

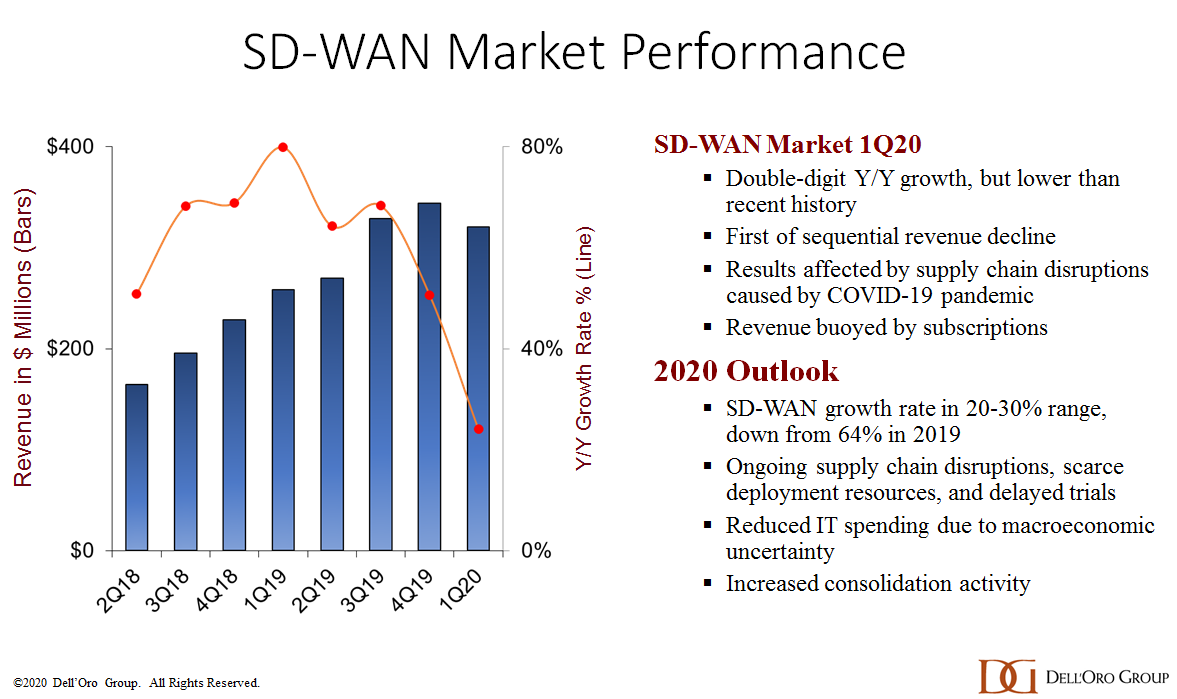

Shin Umeda, Vice President and Analyst, Dell’Oro Group, agrees that there has definitely been a major impact from COVID-19 on the market.

Shin Umeda, Vice President and Analyst, Dell’Oro Group, agrees that there has definitely been a major impact from COVID-19 on the market.

He notes also that the market has become a complex mix of companies: “Some are just software based, some are analytics based and moving into SD-WAN,” he says. “It’s hard sometimes to decipher exactly what companies are doing. It’s difficult for smaller players to gain momentum and to gain the installed base to be able to sustain the business. That’s perhaps why we are starting to see consolidation around a relatively small number.”

Brandon Butler, Senior Research Analyst, Enterprise Networks, IDC is bullish about SD-WAN in the longer term: “This has been one of the fastest growing markets within the enterprise networking market that we’ve been tracking at IDC over the last couple of years. And while 2020 will dampen the market because of COVID, we believe that growth will return towards the end of this year. And then back to a fairly robust growth next year. I think some of the drivers that we see in terms of how businesses are responding in COVID times, relying more on cloud-based applications, for example, will also help to drive SD-WAN adoption into the future.”

Brandon Butler, Senior Research Analyst, Enterprise Networks, IDC is bullish about SD-WAN in the longer term: “This has been one of the fastest growing markets within the enterprise networking market that we’ve been tracking at IDC over the last couple of years. And while 2020 will dampen the market because of COVID, we believe that growth will return towards the end of this year. And then back to a fairly robust growth next year. I think some of the drivers that we see in terms of how businesses are responding in COVID times, relying more on cloud-based applications, for example, will also help to drive SD-WAN adoption into the future.”

So what of the nearly 30% of Futuriom’s respondents who have not as yet made an SD-WAN move? Given all the advantages described by experts and analysts, what is holding them back?

“It’s probably money,” concludes Scott Raynovich, Chief Technology Analyst, Futuriom. “Most technology investment cycles are driven by upgrades. Most of the people I’ve talked to, who are implementing SD-WAN are evaluating branch office routers. Do they buy a new router or buy SD-WAN, which does routing and a bunch of other stuff too. The people that are stuck are probably looking for budget to go through this upgrade cycle.”