When the United Kingdom cast its decisive vote on 23rd June 2016 to leave the European Union, a membership in which it held for more than 40 years, the British pound slumped to a 31-year low as the final polling results sent shockwaves during the Asian trading hours. The losses extended to the European and US trading sessions as panicking investors fled to safe haven assets, and stunned traders caught short by the unexpected outcome rushed to cover their positions. On that day, the pound plummeted more than 10% to $1.33, from $1.50.

While the financial markets absorbed the news and braced for further turmoil over the following days and weeks, no one was quite prepared for the “flash crash” that happened 3 months later, on 7th October, when the currency plunged within a few minutes from $1.26 to $1.15 – marking a fresh 31-year low.

The blame swiftly shifted to “algorithm trading programs”, for triggering market orders that contributed to the massive pressure on the pound as political uncertainties mount.

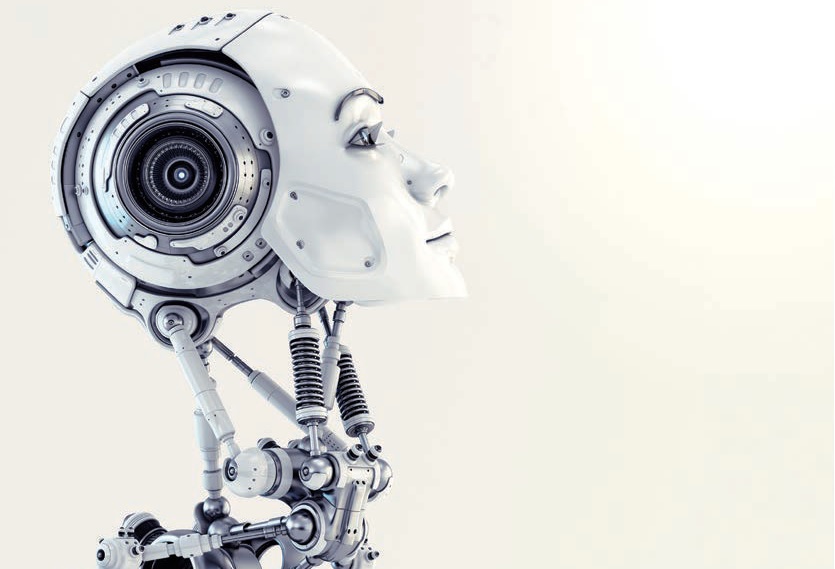

Algorithm-driven robot traders

Algorithm-driven robot traders, a form of “Artificial Intelligence (AI)”, mimic real-life trading using logic, if-then rules, decision trees to behave in ways that resemble an expert trader.

Initially developed to improve trading efficiency by minimizing the manual tracking of financial markets and laborious execution of order (and arguably, also to eliminate trader emotional volatility), these robo-trading algorithms have evolved. From simple sell-buy triggers, to devising trading strategies built on high-speed cross-asset-correlations and other complex mathematical calculations, they have acquired the potential to create systemically contagious impacts as trades from one algorithm could trigger signals of others (as we see in this Brexit example)…Click HERE to read full article.